Seven years after the federal government first offered an option to help some homeowners refinance into more cost-effective mortgages, the program will be extended yet again, and plans for a new refinancing program will be completed. The Home Affordable Refinance Program, or HARP, already has been extended at least twice and it was scheduled to end at the end of this current year. But HARP will continue through September 2017, the Federal Housing Finance Agency said.

U.S. is going to continue HARP home loan package

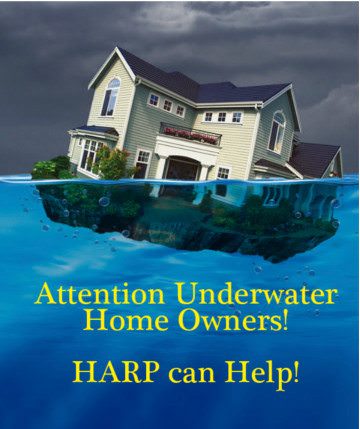

The program, begun as a result of the housing crisis, allows people who owe more than their home is worth, or who have little equity, to refinance into a loan at current low interest rates. (The average rate for a 30-year, fixed-rate mortgage has hovered below 3.5 % for weeks. For the majority of 2008, it was about 6 percent.)

More than 3.4 million homeowners have refinanced their mortgages under the program since it began, according to the housing finance agency, which oversees the mortgage giants Fannie Mae and Freddie Mac. About 18,000 borrowers refinanced under HARP while in the second quarter of this year, down from nearly 20,000 in the first quarter. Still, more than 323,000 loans are estimated to remain eligible for refinancing under HARP.

Erin Lantz, vice president for mortgages with the real estate site Zillow, said about 12 percent of mortgaged homes remained underwater at the end of June. But borrowers may still not be aware that the HARP program exists, she said. Or, because they could have failed to qualify in the programs early years due to missed or late payments, they could think they remain ineligible.

Cora Fulmore, coordinator of the Florida Housing Counselors Network, said some borrowers remained wary, perhaps because of past tussles with lenders. Housing counselors have tried various outreach efforts to get customers to apply, she said, including going door-to-door and offering gift cards to borrowers.

There’s a lack of trust, she said. They’re not believing this program can help them.

Some borrowers could possibly be suspicious that HARP is too good to be true, or they may just not want to take the time to apply, said Jay Plum, head of consumer and mortgage lending at Huntington Bank in Columbus, Ohio. The bank has made overtures to eligible borrowers, he said, going so far as to send HARP document packages to homeowners by overnight delivery.

He urged borrowers who may believe they don’t have refinancing options to have a look at the program, noting that it offers a streamlined application process that often does not require an appraisal. It really is in their best interest, he said.

Madonna Barwick, 49, a teacher who lives in Canfield, Ohio, said a teller at a Huntington grocery store branch shared with her about HARP. She managed to refinance her mortgage this past year, she said, lowering her payment per month by more than $300 and easing her financial worries. Her rate dropped to merely over 4 % from more than 6.6 percent. It absolutely was a blessing, she said.

Here are some questions and answers about special refinancing options:

What loans are considered for HARP refinancing?

Loans must have originated on or before May 31, 2009, and must be owned or guaranteed by either Fannie Mae or Freddie Mac. The property will need to have a loan-to-value ratio the mortgage divided by the homes value of 80 % or more. (A $140,000 house having a $130,000 mortgage would have a loan-to-value ratio of approximately 93%.) The borrower must have had no overdue payments in the previous 6 months, and no more than one late payment in the previous year.

Do I have to do a HARP refinancing with my current lender?

No. You should start by contacting your present loan servicer, but you should also check other lenders to evaluate fees and rates, said Ms. Lantz at Zillow. To discover participating lenders locally, search on the HARP website.

Bob Walters, chief economist with Quicken Loans, said borrowers should not hesitate to ask about HARP if a loan officer does not bring it up: They need to certainly ask.

In what way will the new refinancing option available in October 2017 differ from HARP?

As with HARP, borrowers will most likely have to be current on their payments. Unlike HARP, however, the new refinancing option will not have a cutoff date, so loans made after May 2009 may be eligible. And unlike with HARP, borrowers are able to use the new refinancing option more than once.

The new offering will most likely concentrate on mortgages with loan-to-value ratios of 95 % or higher. Freddie and Fannie say they will announce more details in November.