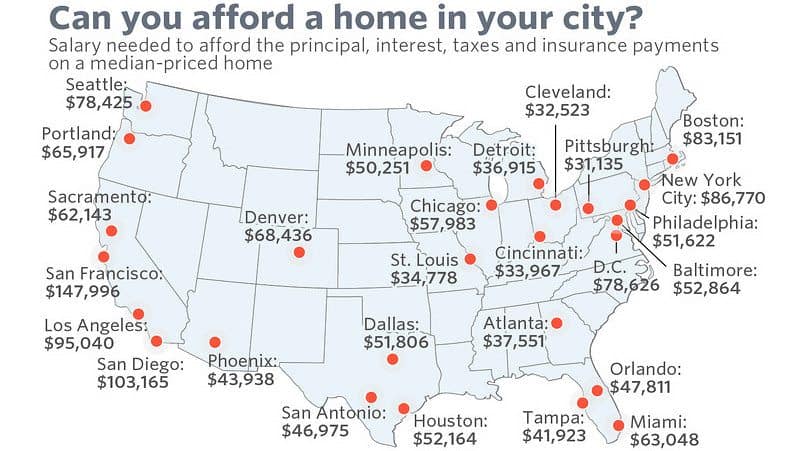

In quite a few cities in the united states, you’ll really need to have a salary higher than the U.S. median income to afford an average home. The typical American would need to make a little over $51,000 annually to afford the median-priced home -including principal, interest, taxes and insurance-in the U.S., a study released this week by mortgage information website HSH.com. This assumes the buyer has good to excellent credit (and for that reason would obtain a mortgage interest rate-depending on location-of around 4%), place down 20% and would be spending no more than 28% of income on principal and interest.

The Salary You Need to Afford a Home in These 25 Cities

Buyers inside the San Francisco area need to make the most money-nearly $148,000-to pay for the median-priced home in their area. Interestingly, residents of the New York area need to make considerably less (roughly $86,700) than those in the San Francisco and San Diego areas ($103,000).