4.5% so far in 2016. The Median Sales Price in May was $222,475, a 4.2% rise from price levels one year ago and 3.5% above the median price in April. The inventory of properties for sale remains very tight in many markets across the country, with the May inventory 14.8% lower than May 2015. At the rate of home sales in May, the national Months Supply of Inventory was 3.0, below 3.2 in April.

4.5% so far in 2016. The Median Sales Price in May was $222,475, a 4.2% rise from price levels one year ago and 3.5% above the median price in April. The inventory of properties for sale remains very tight in many markets across the country, with the May inventory 14.8% lower than May 2015. At the rate of home sales in May, the national Months Supply of Inventory was 3.0, below 3.2 in April.REMAX National Housing Report June 2016

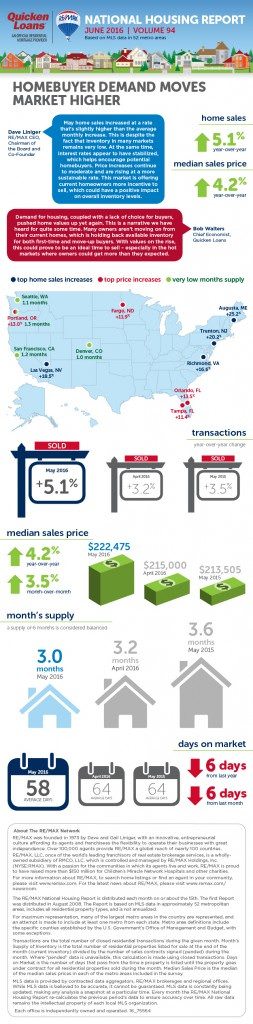

“May home sales increased at a rate that’s slightly higher than the average monthly increase. This is despite the fact that inventory in many markets remains very low. At the same time, interest rates appear to have stabilized, which helps encourage potential home buyers. Price increases continue to moderate and are rising at a more sustainable rate. This market is offering current homeowners more incentive to sell, which could have a positive impact on overall inventory levels,” said Dave Liniger, REMAX CEO, Chairman of the Board and Co-Founder.

“Demand for housing, coupled with a lack of choice for buyers, pushed home values up yet again. This is a narrative we have heard for quite some time. Many owners aren’t moving on from their current homes, which is holding back available inventory for both first-time and move-up buyers. With values on the rise, this could prove to be an ideal time to sell – especially in the hot markets where owners could get more than they expected,” added Bob Walters, Quicken Loans, Chief Economist.

Closed Transactions – Year-over-year change

In the 52 metro areas surveyed in May, the typical number of home sales was 5.1% higher than one year ago, and it was 10.3% higher than the prior month. The sequential monthly increase was higher than the 8.5% average seen from April to May over the past seven years. Like previous months this year, home sales remained strong in the Northeast. Across the nation in May, 34 of the 52 metro areas surveyed reported home sales greater than one year ago, with 16 experiencing double-digit increases, including Augusta, ME +25.2%, Trenton, NJ +20.2%, Las Vegas, NV +18.5%, Richmond, VA +16.6%, Providence, RI +15.8% and Boston +14.3%.

Median Sales Price – Median of 52 metro median prices

The Median Sales Price for all homes sold in May was $222,475, up 3.5% from April, and up 4.2% from the Median Sales Price in May 2015. May is the 52nd consecutive month without a drop in price from the previous year. In 2015, the monthly average of year-over-year price increases was 7.6%. The 4.2% increase in May may mark a moderation in price increases, which could have a very positive impact on home affordability. Among the 52 metro areas surveyed in May, only five experienced a year-over-year drop in prices. Two were unchanged and the remaining 45 metros reported higher prices than last year, with 7 rising by double-digit percentages, including Orlando, FL +13.5%, Portland, OR +13.0%, Fargo, ND +11.9%, Tampa, FL +11.4%, Nashville, TN +10.4% and Denver, CO +10.3%.

Days on Market – Average of 52 metro areas

The average Days on Market for all homes sold in May was 58, down 6 days from the average of 64 in both April 2016 and May 2015. May becomes the 38th consecutive month having a Days on Market average of 80 or fewer. In the three markets with the lowest inventory supply. Seattle, Denver and San Francisco, Days on Market was 29, 23 and 22 respectively. The highest Days on Market averages were seen in Augusta, ME 174, Des Moines, IA 103 and Burlington, VT 92. Days on Market is the number of days between when a property is first listed in an MLS and a sales contract is signed.

Month’s Supply of Inventory – Average of 52 metro areas

The number of homes for sale in May was just 0.8% lower than in April, but 14.8% lower than in May 2015. The typical loss of inventory on a year-over-year basis in 2015 was 12.2%. While inventory remains dramatically reduced than last year, there are indications of stabilization month-to-month. Based on the rate of home sales in May, the Months Supply of Inventory was 3.0, which is nearly identical to last month and last year, 3.2 and 3.6 respectively. A 6.0 months supply indicates a market balanced equally between sellers and buyers. The volume of metros having a Months Supply of Inventory below 2.0 has jumped significantly. While January and February saw 5 and 6 metros below 2.0 and March and April both reported 11, May saw 10 metros with a supply lower than 2 months, including Denver, CO 1.0, Seattle, WA 1.1, San Francisco, CA 1.2, Portland, OR 1.3, Boston, MA 1.5, Omaha, NE 1.5, Dallas-Ft. Worth, TX 1.6 and San Diego, CA 1.6.