Early-career home buyers are usually light on cash, while mid-career home buyers are saving for retirement, and retiree home buyers are facing less income. Each one of these life phases needs a different mortgage strategy. Here are some planning tips to help you make smart decisions, regardless of ... » Learn More about How Mortgage Strategy Differs depending on age

Mortgage Tips

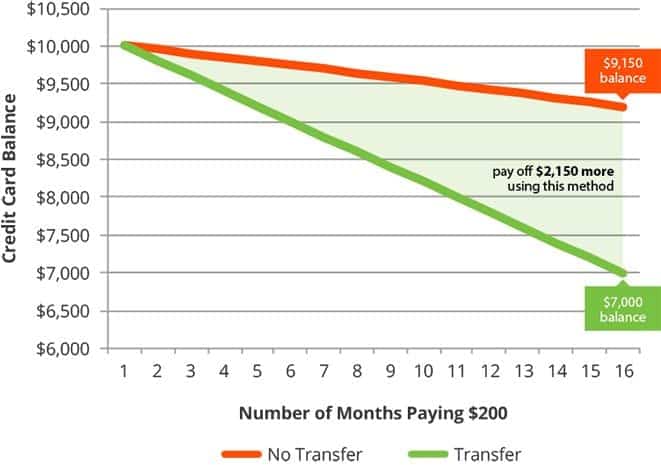

Eliminate Credit Card Debt with 2-Step Process

What's the best way to eliminate a credit card balance as quickly as possible, while paying the least in interest, and without hurting your credit? What follows is actually a powerful method recommended by the most astute personal finance experts to accomplish exactly those objectives. It is very ... » Learn More about Eliminate Credit Card Debt with 2-Step Process

Homebuyers should get pre-qualified with multiple lenders

It appears like the buyers who call us on a daily basis understand more and more that they must get pre-qualified to get a mortgage prior to getting started with the homebuying process. Most also understand or know that shopping for quite possibly the most competitive rates and fees among different ... » Learn More about Homebuyers should get pre-qualified with multiple lenders

First Time Homebuyers a few Recommendations

With a feeling of accomplished in addition to that lingering nervousness and doubt that it will all turn out to be a disappointment or worse, a disaster. First Time Homebuyers will go through a roller coaster of emotions which could end be adding up to the "nerve-wracking" experience especially with ... » Learn More about First Time Homebuyers a few Recommendations

Home loan caps could go away for veterans

March 2, 2016 – An effort is gaining ground to let veterans who use the federally backed, zero-down financing program to avoid worrying about loan caps. Right now, loans backed by the U.S. Department of Veterans Affairs (VA loans) are capped based on market area. Update on Veterans Home ... » Learn More about Home loan caps could go away for veterans