Wells Fargo announced on Thursday that it now offers a down payment of as little as 3% for fixed-rate mortgages, answering calls in the industry to expand the financing box. Wells Fargo now offers 3% down payment mortgages The newest low-down payment program, your First Mortgage, which went ... » Learn More about Wells Fargo now offers 3% down payment mortgages

Down Payment

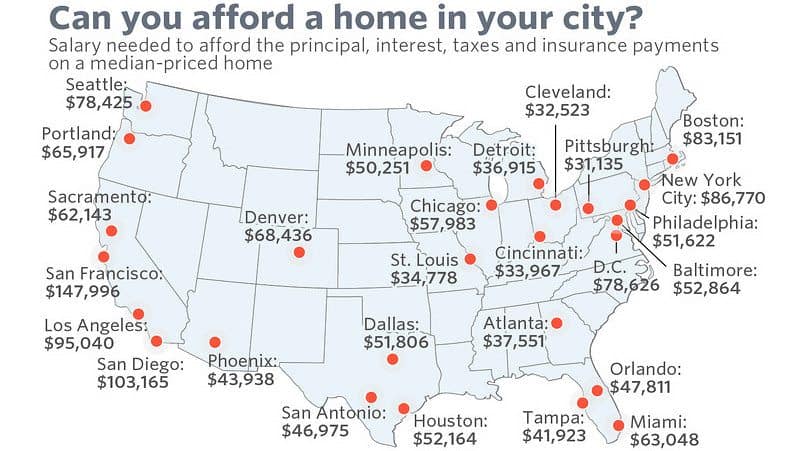

The Salary You Need to Afford a Home in These 25 Cities

In quite a few cities in the united states, you’ll really need to have a salary higher than the U.S. median income to afford an average home. The typical American would need to make a little over $51,000 annually to afford the median-priced home -including principal, interest, taxes and insurance-in ... » Learn More about The Salary You Need to Afford a Home in These 25 Cities

5 Things to Know: Millennials and Home Buying

Millennials are now major players in the home buying arena, according to the recent Home Buyer and Generational Trends report released by the National Association of Realtors: 5 Things to Know: Millennials and Home Buying 1. Millennials made up 35% of buyers in 2015. This is up from 32% in ... » Learn More about 5 Things to Know: Millennials and Home Buying

How to Buy a Home When You’re in Debt

With mortgage rates remaining near historic lows, many financial experts are making the case that student-loan debt doesn't always have to hold back millennials from buying a home. However the message isn't getting across: Nearly 70 % of millennials state they are delaying a real estate purchase ... » Learn More about How to Buy a Home When You’re in Debt

How Mortgage Strategy Differs depending on age

Early-career home buyers are usually light on cash, while mid-career home buyers are saving for retirement, and retiree home buyers are facing less income. Each one of these life phases needs a different mortgage strategy. Here are some planning tips to help you make smart decisions, regardless of ... » Learn More about How Mortgage Strategy Differs depending on age