Many first-time home-buyers receive down payment the help of a family member or close friend, but many do not realize there are specific guidelines they must follow for a home purchase to avoid trouble in the future. Down payment present? Be careful To begin with, the down payment must be a ... » Learn More about Down payment present? Be careful

Down Payment on a Home How Much is Needed

Conforming Mortgage Levels Increase for 2017

The federal government is increasing the levels for conforming mortgages from $417,000 to $424,100 in most areas of the United States starting Jan. 1, 2017, the Federal Housing Finance Agency announced last Wednesday-the first such increase since 2006. Conforming Mortgage Levels Increase for ... » Learn More about Conforming Mortgage Levels Increase for 2017

238 down payment assistance programs Available in Florida

The amount of U.S. down payment assistance programs decreased 3 % from the previous quarter, according to Down Payment Resource's Third Quarter 2016 Home ownership Program Index (HPI). However, of the nation's 2,392 programs, almost 88% actually have available funds for eligible home-buyers, an ... » Learn More about 238 down payment assistance programs Available in Florida

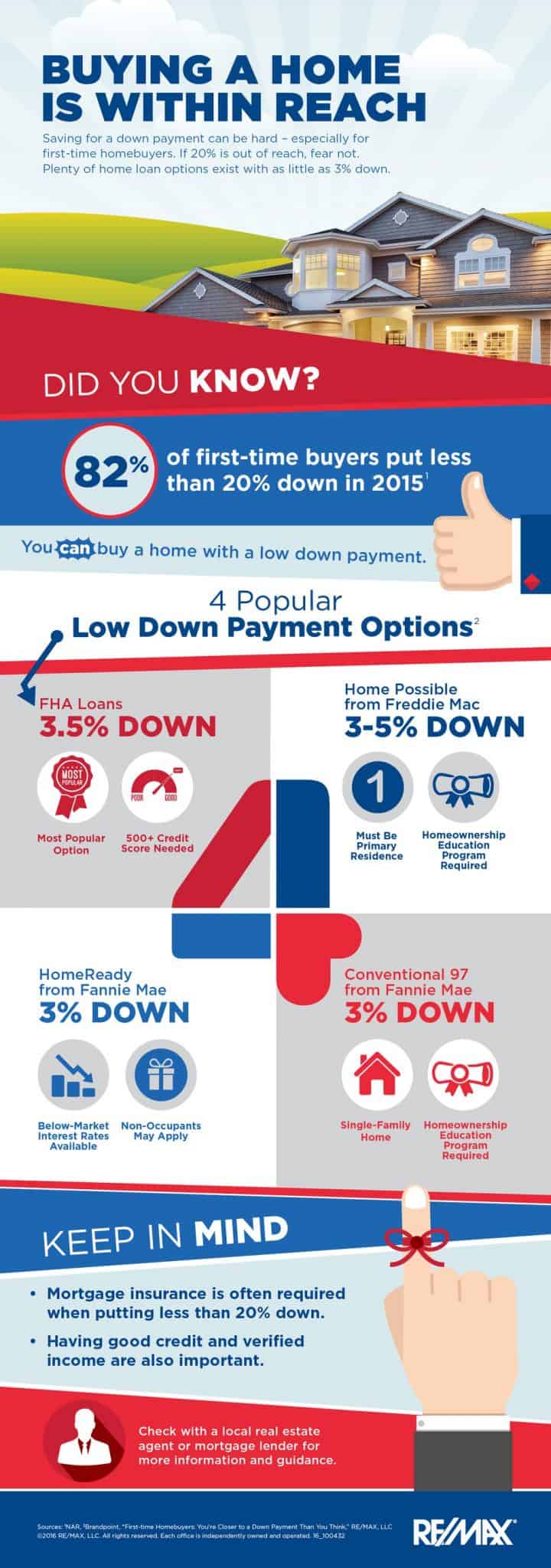

It’s Going to Be Easier to Get a 3 Percent Down Mortgage

HomeReady, the mortgage option that allows borrowers to qualify with income from non-borrower family members, is getting upgrading. It’s Going to Be Easier to Get a 3 Percent Down Mortgage That’s according to government-sponsored mortgage titan Fannie Mae, who announced the following ... » Learn More about It’s Going to Be Easier to Get a 3 Percent Down Mortgage

First-time buyers: You’re closer to a down payment than you think

For many first-time buyers, saving to get a down payment is considered the most difficult step in the home-buying process. However, it's really a common misconception that you need 20% down to purchase a home. Actually, lenders throughout the country offer mortgage products with very affordable ... » Learn More about First-time buyers: You’re closer to a down payment than you think