Low interest rates and far better loan processing have produced the smallest national degree of loan defect and misrepresentation in the recent past, according to First American Financial Corp. The financial firm’s Loan Application Defect Index shows defect and fraudulent information submitted on loan requests dropped 2.8% from June to July, and 16.7 % from July 2015.

The index detects and tracks the frequency of fraudulent, defect and misrepresentation in home mortgages. Apart from the brief period between October 2012 and January 2013, mortgage rates are at the lowest point since Freddie Mac has been tracking since 1971, the index shows.

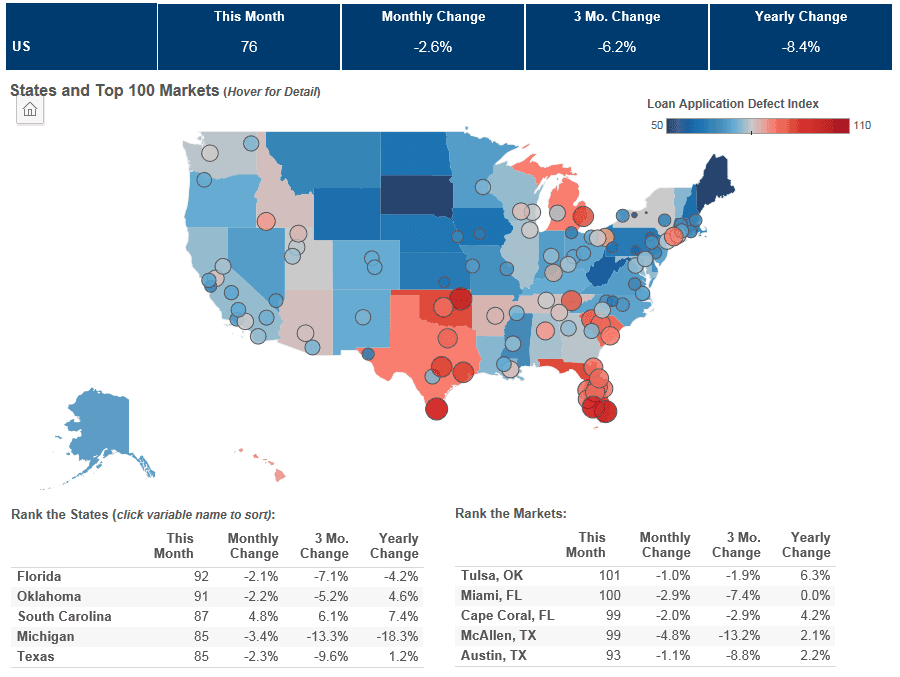

Loan problems and misrepresentation declines nationally

First American reports that the defect index is improving as refinance activity continues strengthening in the market.

Refinance transactions have likewise decreased over the month and year. Currently, refinance transactions in the index are 1.7 percent lower than the previous month and 18.1 % less than July 2015, First American says.

Defect Index decreases and increases by market

The complete Defect Index for July received a score of 70. The index will be based upon a benchmark value of 100, which had been determined in January 2011. Difference in the Defect Index is based on the numbers of defect indicators identified in loan applications.

The San Francisco metro’s Defect Index decreased 18.99 percent year-over-year, to 64. There’s been steady decline over the summer, with a 1.54 percent decrease month-over-month in July. There was a 5.88% decrease on the three-month cycle.

The Los Angeles metro’ year-over-year index drop is just shy of San Francisco’s, at 18.82 %. The Defect Index for Los Angeles is 69.

The Defect Index for Greater Houston is at 89 and is unchanged from the previous month. The yearly decrease is 11.88%, with only 2.2% change over the past 90 days.

The index in the Miami metro is down 24.32% since July 2015, to 84. There was a 1.18% drop from the month prior, as well as a 7.69% decrease over the past three months.

There was no change in the month for New York City. NYC’s Defect Index of 71 puts it directly on track with the national level. Since July 2015, that figure has decreased 14.46%.

The index for the Chicagoland metro is at 70, down 18.6 percent year-over-year and 2.78% month-over-month.

Defect applications for the loan indicators within the Baltimore metro were unchanged from the previous month, leaving the Index rating at 69. That is a reduction in 14.1 % within the year, and 4.29% over the past three months.

The Defect Index in the Washington D.C. metro is on track with the national rating of 70. There was slight change over the month, with a 1.41% decline, and a 7.89% drop percent year-over-year. Nick & Cindy Davis have assisted over 250 families negotiate a short sale for their home. If you need assistance with a loan modification or short sale. You can reach us at 813-300-7116 or simply click here and we will be in touch.