One of the first indications that the real estate market is in trouble is foreclosure rate – so it’s helpful to maintain a close eye on that. Black Knight Financial Services, which provides technology, data and analytics for lenders and servicers, released its “Mortgage Monitor” for April 2016. Here’s how Florida is comparing to the remainder of the country.

How does Florida compare well to national foreclosure rates?

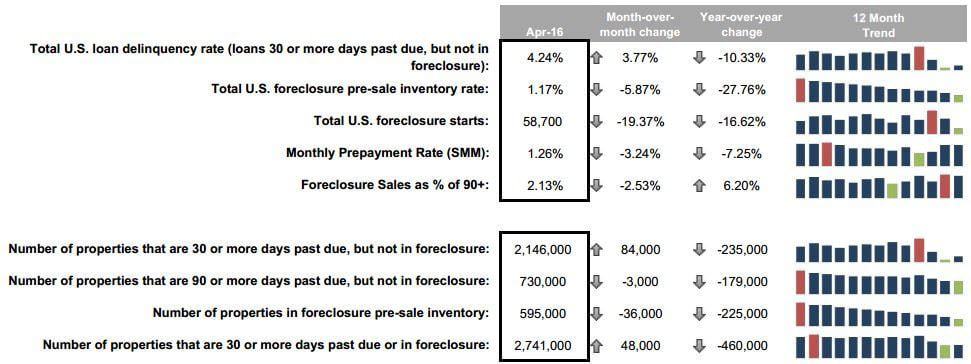

The overall amount of non-current loans in the United States in April 2016 was 5.4 percent. This is down 14.6 % year-over-year. The total number of delinquent loans (30 or more days past due, but not in foreclosure) was 4.24 percent nationally.

Florida in general remains below the national average, but the scenario is much improved from a year ago. The complete number of non-current loans in the state was 6.6 %, down a staggering 23.9 % year-over-year.

The total quantity of delinquent loans in the state was 4.5 percent.

So as you can imagine, the foreclosures that are on the market today are far lower than they were in 2009. What we are seeing here in the Tampa Bay area is that the bank’s that are putting money back into the foreclosed homes are selling for closer to market value than the banks that are doing no repairs. If you are interested in finding your new home here in the Tampa Bay and surrounding areas. Contact Nick & Cindy Davis at 813-300-7116 or simply click here and we will b e in touch shortly.

So