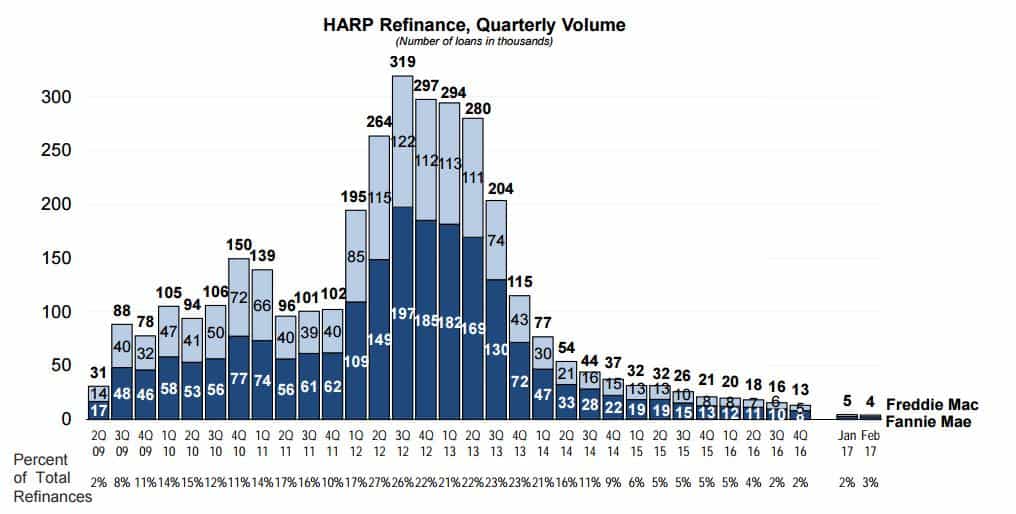

The Home Affordable Refinance Program or HARP may be in its waning days, but is still being used by upside down homeowners. The Federal Housing Finance Agency (FHFA) released its Q1 Refinance Report showing that Fannie Mae and Freddie Mac completed over a half million refinances throughout the quarter, and 3% (13,425) were completed by HARP.

HARP Continues to Help Upside down Homeowners

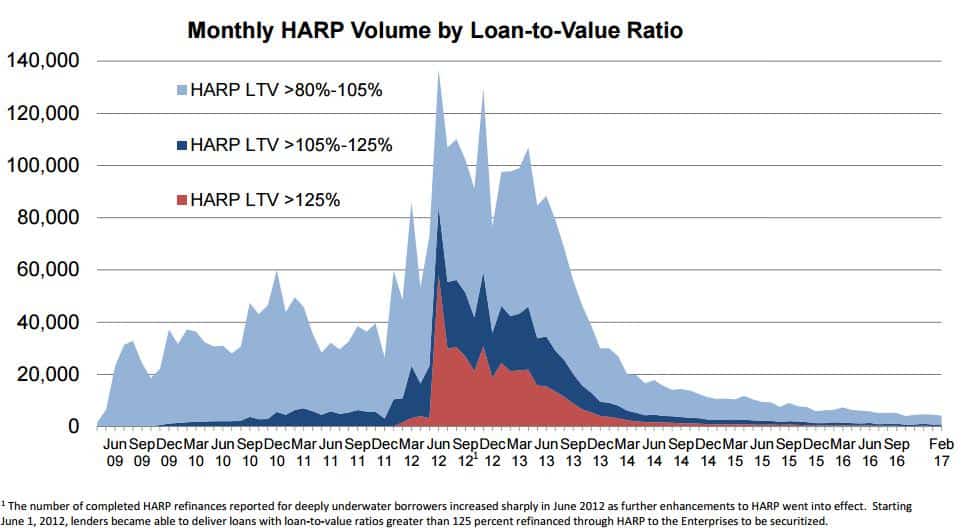

The program was initiated in 2009 to assist borrowers with little if any equity in their homes to refinance into lower interest loans. It was originally limited to a resulting mortgage of a maximum of a 125% loan-to-value (LTV) ratio, but that cap was removed in 2012. Since the program’s inception 3,361,096 borrowers have used it to refinance.

FHFA said that there was a total of 510,000 refinances during the quarter, down from 750,767 in the fourth quarter of 2016. Fannie Mae completed 302,686 refinances of all types and 207,391 were done through Freddie Mac.

At one point, more than half of HARP refinances resulted in loans with a LTV ratio over 105% and more than half of those exceeded 125% but those extremely negative refis have diminished. In the first quarter of 2017 only 19% had LTV’s that exceeded 105%. 24% of those high negative equity borrowers refinanced into short-term mortgages which build equity faster.

FHFA estimated that there were still 137,594 homeowners who could benefit financially from a HARP refinance at the end of last year. These borrowers meet the basic HARP eligibility requirements, have a remaining balance of $50,000 or more for their mortgage, with a remaining term greater than 10 years, and their mortgage interest rate is at least 1.5% greater than current market rates. These borrowers could save, an average of, $2,400 annually by refinancing their mortgage through HARP. Ten states account for over 60 % of those having a remaining incentive to refinance. Florida leads the list with over 15,500 homeowners, followed by Illinois, Michigan, Ohio, and Georgia.

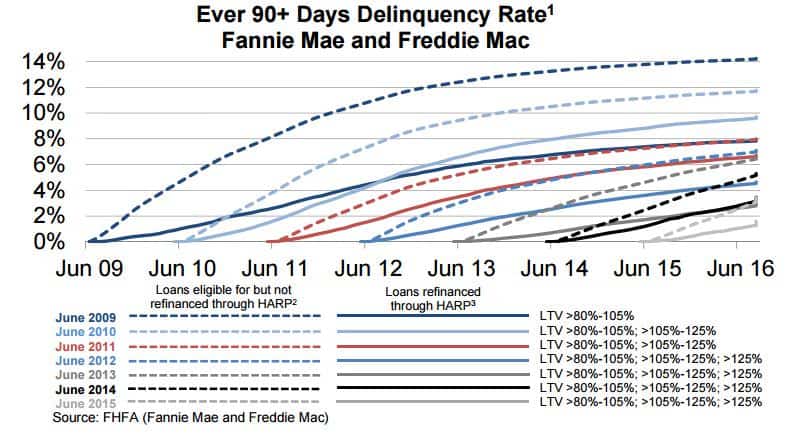

Borrowers with HARP refinanced mortgages have maintained a lower delinquency rate compared to those borrowers who had been eligible for the program but did not utilize it.

Nick & Cindy Davis have assisted over 250 families here in the Tampa Bay Area that were upside down with their loan and successfully negotiate a short sale. If you have tried to work with your mortgage holder and still are upside down and the lender is not willing to modify your mortgage, give us a call at 813-300-7116 or simply click here and we will be in touch.