That was before Brexit, that might hit Florida, Texas and California. Foreign buyers retreated from the U.S. real estate market this past year as a strong dollar, rising home prices and slowing overseas economies crimped buying power.

Foreign Investors Pulled Back From U.S. Real Estate

Investors specifically poured dramatically less money into U.S. rental and vacation properties, based on a survey from the National Association of Realtors, slashing their spending by $10 billion just to $35 billion, a three-year low. The annual NAR survey is one of the industry’s best snapshots of international activity in the U.S. housing marketplace. While global clients account for a small share of overall U.S. home sales, their pullback might be felt in markets favored by foreign buyers, including areas of Florida, California, Texas, Arizona and New York.

“Weaker economic growth throughout the world, devalued foreign currencies and financial market turbulence combined to present significant challenges for foreign buyers over the past year,” said NAR chief economist Lawrence Yun. The Realtor survey tracked residential purchases between April 2015 and March 2016. For the year, sales to foreign buyers totaled $102.6 billion, below a study high of $103.9 billion a year earlier.

So what?

NAR’s survey was taken in April and didn’t capture the aftermath of the U.K. decision to abandon the economic alliance of the European Union. The British exit – Brexit – has crashed the British pound, boosted the U.S. dollar and whipsawed stock markets. British buyers spent $5.5 billion to acquire 9,150 U.S. properties this past year. That’s not really a drop in the bucket of the 5.5 million homes sold in the U.S. each year, and the British accounted for merely a small share of foreign buyers. Chinese buyers, by contrast, spent $27.3 billion, more than the next four countries combined.

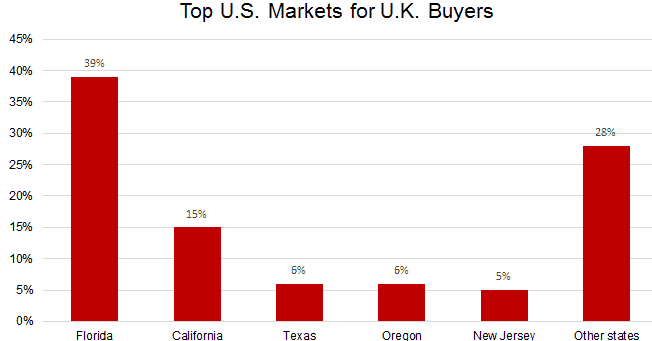

But U.K. buyers like warm-weather climes as well as their purchases are concentrated in places like Miami, Tampa and Orlando. Nearly 40 percent of the homes they bought last year were in Florida. “Sales activity from U.K. buyers could very well subside over the next year depending on how severe the economic fallout is,” Yun said. “However, with economic instability and political turmoil outside of the U.S. likely to persist, the world view of American real estate as a safe investment should keep demand firm even as pressures from a stronger dollar continue to weigh down on affordability.”

Translation: The loss of U.K. buyers won’t be a huge blow and we think the housing market can withstand Brexit. Stay tuned. The rental demand may actually be higher here in the Tampa Bay and Surrounding Areas right now. So it could possibly be a great time to purchase an investment property or two. Nick & Cindy Davis work with several Foreign Investors who are doing rather well in keeping their properties rented continuously. If you need some help we are just a click here away. Or you can always reach us at 813-300-7116.