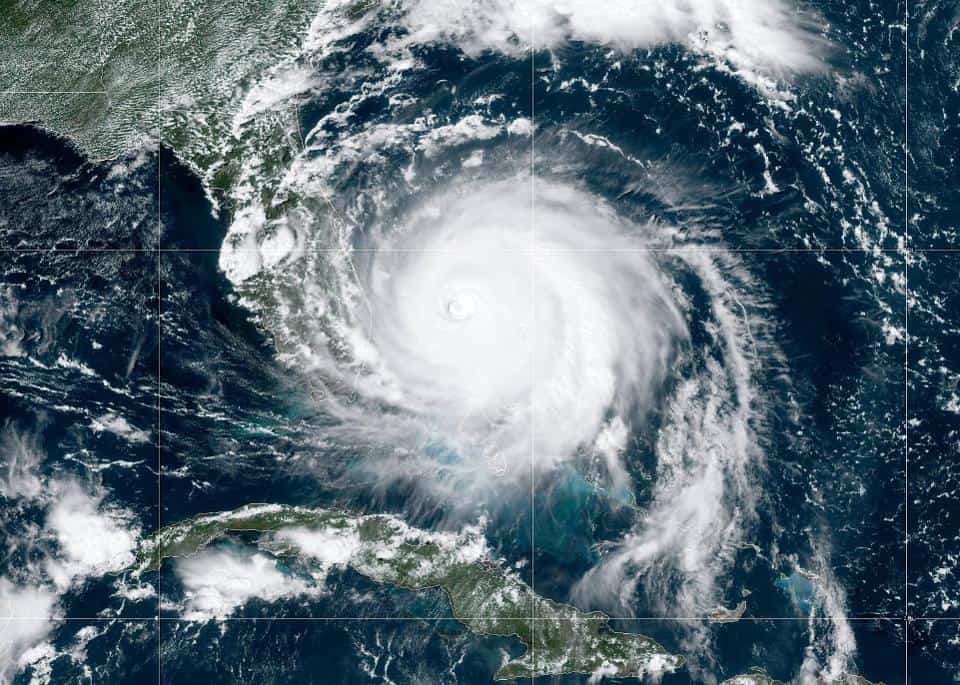

How exactly does the force majeure provision in the Florida Realtors/Florida Bar “As Is” contract work given that a hurricane has interrupted some transactions? Meaning “superior force” in Latin, force majeure outlines just how a buyer and seller will continue.

Contracts and ‘Force Majeure

“When hurricanes impact real estate transactions, many Realtors scramble to search for casualty and bad weather provisions,” says Florida Realtors Associate General Counsel Joel Maxson. “The short inventory below provides an overview of key provisions in the Florida Realtors/Florida Bar “AS IS” Residential Contract for Sale and Purchase revised in June of 2019, along with one reference to the casualty provision contained in the Florida Residential Landlord and Tenant Act.”

Section 18(G) Force Majeure

This is an automatic extension that comes into play when a dramatic event prevents a party’s performance or closing from happening. It takes an unusual and unplanned event to trigger this “Force Majeure” clause, as you can see from a few of the examples given, such as, hurricanes, acts of God and acts of terrorism. Once the clause is triggered, though, certain time periods (including the closing date, if applicable) will be extended for a reasonable time up to 7 days after the force majeure no longer prevents performance. Parties should pay attention to the time in relation to the closing date, though, since either party may terminate the contract by delivering a written notice if force majeure continues to prevent performance more than 30 days beyond the closing date.

Section 18(L) Access to Property to Conduct Appraisals, Inspections, and Walk-Through

After a hurricane passes over a property, a buyer often wants to take another look at the property, regardless of whether the buyer is still in the inspection period. This clause generally favors the buyer’s request, as it provides that “Seller shall, upon reasonable notice, provide utilities service and access to Property for appraisals and inspections, including a walk-through (or follow-up walk-through if necessary) prior to Closing.”

Section 18(M) Risk of Loss

If the buyer or seller discover casualty damage from the hurricane, this clause describes the rights and obligations of each party. If the cost to restore the property does not exceed 1.5 percent of the purchase price (this cost includes the cost of pruning or removing damaged trees), then the cost is a seller obligation. If the restoration isn’t complete prior to closing, the seller will escrow a sum equal to 125 percent of the estimated cost to complete the restoration. If the cost of restoration exceeds 1.5 percent of the purchase price, then the buyer has the option to either take the property along with 1.5 percent of the purchase price, or receive a refund of the deposit, releasing buyer and seller from all further obligations under the contract.

Section 83.63, Florida Statutes (Casualty Damage)

This brief section simply provides that if rented residential premises are damaged or destroyed “so that the enjoyment of the premises is substantially impaired, the tenant may terminate the rental agreement and immediately vacate the premises.” This section continues to present a second scenario whereby a tenant may “vacate the part of the premises rendered unusable by the casualty, in which case the tenant’s liability for rent shall be reduced by the fair rental value of that part of the premises damaged or destroyed.”

Have questions? Contact an attorney to discuss your specific situation.

Force majeure provisions are usually overlooked when the sun is shining and deals are closing without incident, but it’s beneficial to know where that they are, so you can get to them quickly in the event the winds are blowing.

Have a questions or concern? Nick, Cindy & Nicholas Davis with RE/MAX Premier Group are here to assist you with all your Real Estate Needs. We are always available at 813-300-7116 to answer your questions or you can simply click here and we will be in touch with you shortly.

Need to get started with your mortgage process? You can contact Kyle Edwards with Iberia Bank at 813-495-5131, or simply click here to start your online application.