What’s the best way to eliminate a credit card balance as quickly as possible, while paying the least in interest, and without hurting your credit? What follows is actually a powerful method recommended by the most astute personal finance experts to accomplish exactly those objectives. It is very effective, completely legal, and leverages programs created by credit card issuers in your favor. Adopt these measures and begin to eliminate credit card debt.

Eliminate Credit Card Debt with 2-Step Process

Step 1: Make use of a Powerful Tool To instantly Quit paying Interest On Your Balance

Think of someone carrying a credit card balance like a patient who enters an emergency room bleeding badly. The very first thing a doctor is going to do is stop the bleeding. It’s really no different when attacking a credit card balance; the very first thing you do is stop the interest fees.

There’s a simple way to do this, and it’s brilliance is that it actually uses the banks’ marketing offers to your benefit: look for a card offering a long “0% intro APR balance transfer” promotional offer, and transfer your balance to it. These include cards which offer new customers an extended period of time (often as much as 18 months) during which the card charges no interest on all balances transferred to it. We constantly track all of the cards in the marketplace in order to find the ones currently offering the longest 0% intro periods.

If you would like more motivation, just think of this: on a $10,000 balance, $150 of a $200 payment per month would get vacuumed up by interest fees.** That leaves only $50 of your $200 that actually reduces your balance, the rest vanishing into bank pockets. That’s just brutal. Use our reviews to get yourself a card that offers the longest possible no-interest period while charging low, or perhaps no fees. Moving your balances to the card you choose will stop the bleeding, enabling you to move on to step two.Step 2: Power Via your Balance During The 0% Period.

If you would like more motivation, just think of this: on a $10,000 balance, $150 of a $200 payment per month would get vacuumed up by interest fees.** That leaves only $50 of your $200 that actually reduces your balance, the rest vanishing into bank pockets. That’s just brutal. Use our reviews to get yourself a card that offers the longest possible no-interest period while charging low, or perhaps no fees. Moving your balances to the card you choose will stop the bleeding, enabling you to move on to step two.Step 2: Power Via your Balance During The 0% Period.

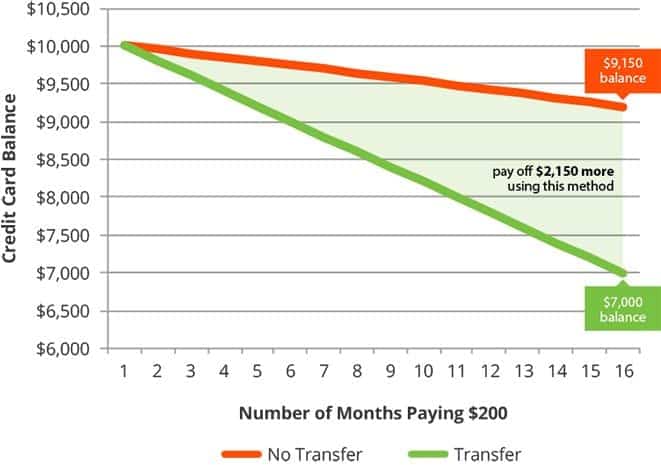

Once you’ve transferred your balances and put a stop to the interest fees, it’s time to capitalize on the interest-free period to really break free of your debt. The best part of this is how simple it is: just keep making the payments you used to make when you had to pay big interest charges. Going back to the $10,000 example above, if you transferred that balance onto a card such as the Chase Slate (that offers 15 months of 0% intro APR with no transfer fee) and maintained the same $200 payment per month, you will see just how much faster you’ll be lowering your balance in the chart below.

As we discussed, without using the 0% card, the identical $200 monthly payments barely make any headway. It’s like swimming upstream, or walking while taking a step back for every two steps forward. That’s absolutely no way to swim or walk, and trying to eliminate your cards while paying high card interest rates is no way to manage your finances. Move your balances onto one of the cards below, stop getting crushed by interest, and commence making real progress toward getting rid of your card debt.

Using this process to eliminate your credit card debt, will definitely put you into a good position to purchase your new home. So if or when you are ready, we are here to assist. You can always reach us at 813-300-7116 or simply click here and we will be back in touch with you.