“Sell my house!” As a seller there are costs associated in selling. It can be extremely disappointing to plan to get a special amount from the sale, solely to figure out that your actual proceeds are considerably less. And what items can the seller be required to pay at closing?

Costs of selling a house

The seller pays the commission to the real estate agent who lists and sells the house. Needless to say, this fee is typically 6% being the average in the Tampa Bay area. Normally this will split with the two real estate agents who are involved with the sale of the house.

Title insurance serves as a guarantee to the buyer that the title is clear and that there’re no unpaid finance charges, liens, loans and judgments that will cause defects of the title at the sale time. It is according to the sales price and where you live, this typically costs between $400 and $1500. The business who performs the closing, typically a Title Company or an attorney, will charge a fee for the search, exam and other processing fees.

There are some other fees that are charged to the seller as well. If you live in a community where there is a Home Owners Association. They will charge to have an ESTOPPEL Certificate prepared to ensure that there are no outstanding dues or violations on the property. The Title Company is responsible for making sure paperwork is correctly signed and notarized and dispersing most of these finances to the all recipients.

Now please pay attention to this part. The seller will be required to pay all expenses such as insurance, utilities, taxes and mortgages up to the closing date. If you have a second mortgage or equity line of credit; that will need to be paid as well. You cannot sell the house with satisfying a second mortgage or equity line. The only figures we really cannot give you a pretty close estimate on is how much money you have in escrow with your mortgage holder. These funds typically will be dispersed to you 30-45 days after closing and the satisfying of the mortgage.

If the buyer needs assistance with their closing costs they may make it with their offer. It typically will be a percentage or dollar amount. This will assist them in being able to pay all necessary fees at the time of purchase.

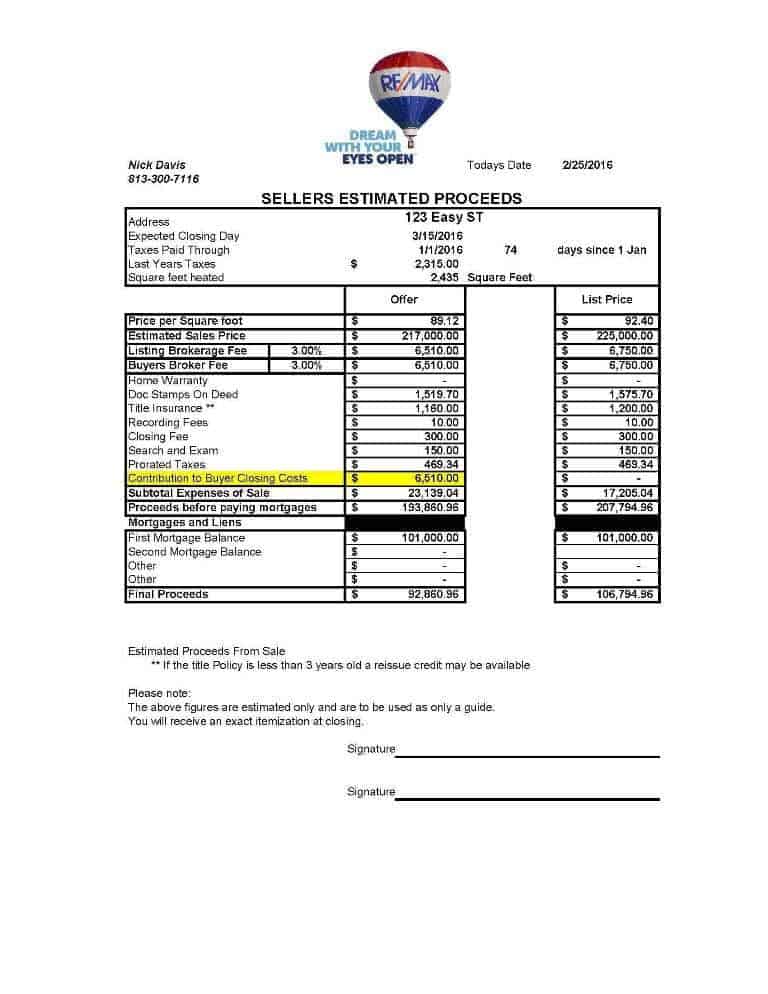

One thing that Nick & Cindy Davis is do is we prepare a Sellers Estimated Net Sheet when we list your house for sale. And then when we come meet with you with the offer we prepare it showing the terms and conditions of the offer that is being presented. We have the ability to tweak it while we are together if you were to decide to counter the buyers offer. We can still give you an estimate of what you should expect to receive at the time of closing on the sale of your home.

So if you are ready to have us sell your house for you. We are simply a call to 813-300-7116 or click here away.