Moving is often stressful for each and every family member - including the four-legged ones. Every animal reacts differently to new living quarters, and temperament has a lot to do with it. Some pets take a move in stride, and others exhibit anxiety or insecurity for a few days or ... » Learn More about Paw-sitive Reinforcement: 5 Approaches to Help Pets Adjust Following a Move

Home buying

First-time homebuyers: You’re even closer to a down payment than you believe

For the majority of first-time buyers, saving for a down payment is considered the most difficult step in the home-buying process. However, it's actually a common misconception that you always need 20% down to purchase a home. First-time home buyers: You're even closer to a down payment than you ... » Learn More about First-time homebuyers: You’re even closer to a down payment than you believe

Nonprime loans widen mortgage choices

Subprime mortgages - which were blamed for sparking the last housing crisis - are reappearing, but this time they're dubbed nonprime loans. This lending option, which carries new quality standards, is growing for buyers with damaged credit. Nonprime loans widen mortgage ... » Learn More about Nonprime loans widen mortgage choices

5 Budgeting Recommendations For Buying a Home

Buying a home is going to be one of the largest financial transactions you make, and preparing your finances beforehand will make the home buying process far less stressful. The following recommendations and expert insight will assist you to get your budget in order prior to making the important ... » Learn More about 5 Budgeting Recommendations For Buying a Home

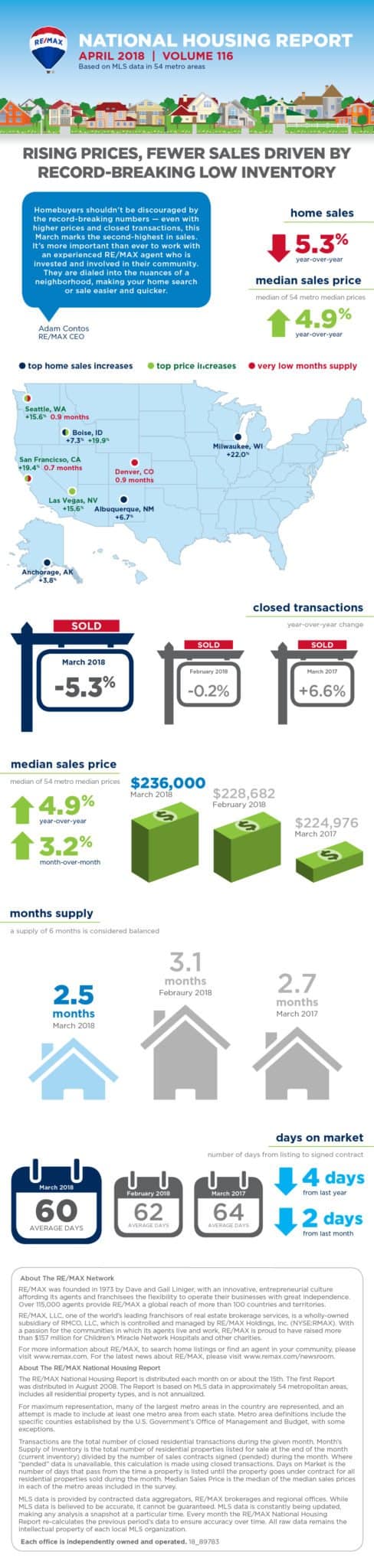

April 2018 RE/MAX National Housing Report

Rising Prices, Fewer Sales Driven by Record-Breaking Low Inventory. If you are searching for a new home, odds are you’re not finding many homes on the market. If you’re a seller, you might have likely noticed the value of your home is rising - regardless of what area of the country you are located ... » Learn More about April 2018 RE/MAX National Housing Report