Rates on mortgages are hovering just above their lowest point of the year, Freddie Mac reports in its weekly mortgage market survey. Rates on mortgages Drop, To Near 2016 Lows "The Fed's decision to stand pat followed by a week of assorted unsettling news drove Treasury yields lower," says Sean ... » Learn More about Rates on mortgages Drop, Near 2016 Lows

Home buying

Your HOA Payments May Now Affect Your Credit Score

Homeowner associations may be great for neighborhood maintenance, settling disputes and enforcing community guidelines, but every one of the benefits come with a cost: the association dues. A good chunk of American homeowners agree to pay them-nearly 25%, according to RealtorMag.org-but unlike the ... » Learn More about Your HOA Payments May Now Affect Your Credit Score

Military niche has younger buyers, bigger homes

Out of all adults younger than 35, the share of active-service military members who purchase a home significantly outpaces the share of non-military homebuyers. According to the National Association of Realtors® (NAR) first-ever study of military clients, the 2016 Veterans & Active Military Home ... » Learn More about Military niche has younger buyers, bigger homes

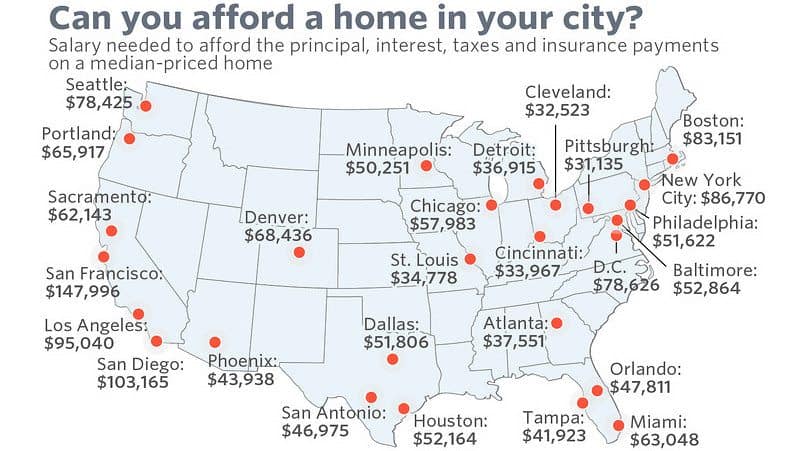

The Salary You Need to Afford a Home in These 25 Cities

In quite a few cities in the united states, you’ll really need to have a salary higher than the U.S. median income to afford an average home. The typical American would need to make a little over $51,000 annually to afford the median-priced home -including principal, interest, taxes and insurance-in ... » Learn More about The Salary You Need to Afford a Home in These 25 Cities

Private flood insurance support bill in Senate’s hands

A bill geared towards encouraging more private companies to offer flood insurance passed the U.S. House of Representatives by way of a unanimous 419-0 vote last week, and now the wait starts to find out whether the Senate starts moving forward on an equivalent bill. Private flood insurance ... » Learn More about Private flood insurance support bill in Senate’s hands