Low credit ratings have be burdening many Millennials, and preventing them from purchasing a home, according to a survey by TransUnion. The survey revealed that 32% of Millennials plan to purchase a home within the next 12 months, however 43% currently hold a subprime credit rating. On the other ... » Learn More about 6 tips for Millennials to improve their credit scores

Home buyers

What to Do After a Seller Rejects Your Offer

You’ve got your heart set on that 3-bedroom charmer, however the seller rejects your offer. Now what? Trying to find a home can be a lot like looking for true love. You may meet many prospects before you find the one. And sometimes, you could possibly wish for a prospect a lot more than they long ... » Learn More about What to Do After a Seller Rejects Your Offer

First-time buyers save longer and buy bigger

As the peak home buying season begins, first-time homebuyers are prioritizing their long-term residential needs, in accordance with the inaugural Bank of America Homebuyer Insights Report. Seventy-five percent of first-time buyers would prefer to bypass the starter home and buy a bigger place which ... » Learn More about First-time buyers save longer and buy bigger

Home Features Most sought after by Age

Home buyers are demanding more home features that really help them save energy and keep the home organized, a new study released by the National Association of Home Builders, “Housing Preferences of the Boomer Generation: How They Compare with Other Home Buyers" reveals. However, the generations - ... » Learn More about Home Features Most sought after by Age

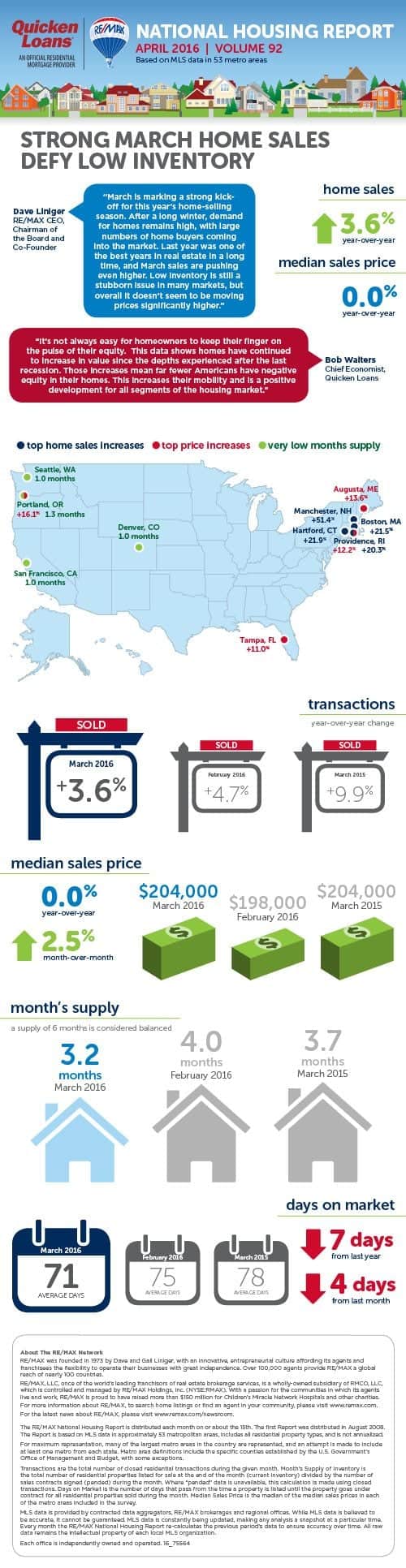

April 2016 National Housing Report

The 2016 home buying season began in March with a 33.4% jump in sales from February among the 53 metro areas surveyed for the RE/MAX National Housing Report, which is a little better than the 31.0% seven-year average of February to March increases. March sales were also 3.6% greater than sales one ... » Learn More about April 2016 National Housing Report