What buyers should be aware of before purchasing public auction foreclosures

These risks are:

Knowing the priority of the mortgage being foreclosed

Being able to estimate the amount of rehab a house will need properly without gaining interior access

Determining whether there’ll be any certificate of occupancy (CO) issues

Determining whether a house is occupied or vacant and all that is entailed with a legal eviction

Properly estimating the resale of a property after the renovations are completed

Knowing the mortgage priority at a foreclosure sale

Many properties that are going to foreclosure have multiple mortgages on them. Speculators must do proper due diligence before each foreclosure auction to ensure they are fully aware whether or not they will be bidding on a first lien or a subordinate lien.

However, the fact is that usually less than 50 % of the properties that are scheduled to go to sale actually go off on any particular day. Thus, investors must do extensive research on numerous properties, all the while realizing that at least half their research will probably be for naught.

Even experienced investors have sometimes unknowingly placed bids on properties where the second or third lien is now being foreclosed, only to discover that they must pay the balance of all the superior liens.

In such cases, what was considered to be a profitable deal quickly deteriorates right into a substantial loss. But once a foreclosure sale is completed and the down payment has been tendered to the court-appointed referee, there is no turning back.

Investors who bid on a subordinate lien without knowing what exactly is owed on the superior lien or liens will lose their down payment should they not complete the purchase of the house. Foreclosing banks do not want to hear the words, “Please give me my money back. I made a mistake!”

In cases where a speculator does understand that they are bidding on a subordinate mortgage, it’s still almost impossible to be aware of the exact payoff of that lien.

Yes, many counties already have websites where investors can look at a detailed list of mortgages and liens against a house. But, just having the original amount of a superior lien isn’t going to tell one the existing balance due.

When a mortgage goes into default, the loan is accelerated, meaning the interest rate increases and the loan becomes fully due and payable. Thus, with accelerated interest now accruing for the entire outstanding balance, late fees, payments for insurance and taxes, attorney’s fees and so on, the total due on a loan can easily double in just a few years.

Before the foreclosure sale, loan payoffs are only provided to the mortgagor upon request, not investors thinking about bidding at the auction. The best most speculators are able to do is to approximate the payoff amount.

Unfortunately, even the savviest investor will often find that his or her approximation of the amount currently due will be significantly off the mark once the loan payoff has been generated after the sale.

Estimating the amount of rehab a property will need

It is illegal for a speculator to enter a vacant property before the foreclosure sale. Therefore, most investors will need to extrapolate interior condition from an exterior assessment.

Although it is true that a variety of speculators will enter a vacant property before a foreclosure sale no matter the legality of doing so so that they are able to gauge better the repairs needed, the fact remains that it’s very difficult to be aware of exactly what lurks behind walls, under floors, in roof rafters and so on with merely a quick view.

Thus, estimating the repair cost in advance of a house being foreclosed requires a great amount of skill and is often the difference between a deal being profitable or incurring a loss. Many speculators have lost quite a lot of money as a result of underestimating the repair cost of the foreclosure they purchased.

Missing certificates of occupancy

Many homeowners build on to their homes without securing the appropriate certificates of occupancy (COs) from the town. What appears to be a colonial could simply be a ranch having an added second floor where the homeowner has built onto the house without obtaining the proper permits and COs. Thus, speculators can many times find themselves in situations where they can’t resell a property seeing as there are no COs in place. If a variance is needed from the town, the length of time an investor can be stuck in a deal could increase substantially.

Investors usually expect a deal time period of 4 to 6 months. In case a variance is needed, that deal length could easily double or triple.

Thus, with the added holding costs, permit costs, etc., a foreclosure deal can easily turn negative before one knows it.

One might wonder, “Isn’t it incumbent upon one bidding at a foreclosure sale to research all the COs on a property?” The correct answer is, naturally, yes. But, this is easier said than done.

Often this sort of information is only accessible through the Freedom of Information Act (FOIA) request at the town, which can take weeks to answer.

Also, keep in mind that only half the scheduled foreclosures go off, so it’s virtually impossible to research every potential property acquisition completely in advance of the sale. Thus, missing COs presents a substantial risk to those speculating in foreclosure sales.

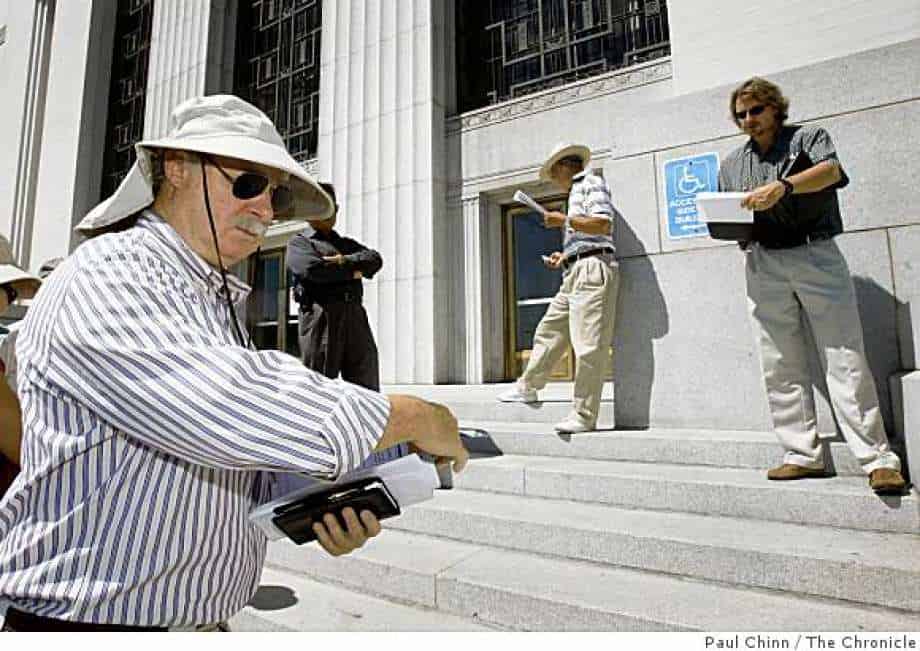

Dealing with occupied homes

Not every foreclosed properties come vacant. Many times the prior homeowner/occupant will remain in the house until he or she is legally evicted.

Some counties can process evictions in just a few weeks, and in other counties, the eviction process might take several months. Some states even have laws requiring that tenants be given 90 days notice prior to the eviction process being initiated.

The time spent handling prior homeowners, tenants in possession as well as squatters can easily turn a profitable deal right into a losing one.

Properly estimating the resale of a property before the foreclosure sale

Another section of risk connected with purchasing foreclosures at auction is the ability properly to figure out the resale value of the property once it has been rehabbed. When there are actually identical houses on a block, and numerous recent sales in the public records, a speculator’s task of knowing what a house will sell for is not all that difficult.

The problem arises when there is no prior listing on a particular property to determine the room count along with other pertinent attributes, or even the neighborhood has several different house types on the same block or not enough comparable sales to determine value.

Let’s say an investor strikes down a property for $150,000 that he or she expect will require $50,000 worth of rehab. After the house is minted out, he or she expect it to sell for $250,000.

After factoring in title and legal fees at the purchase closing, insurance, real estate commissions, property taxes along with other holding and resale costs, the investor expects to produce a profit of $30,000, or 15 %, on his money.

However, if he overestimated the resale price of the property and it only is sold for $220,000, all his time, money and effort are wasted on a break-even deal.

If the repair costs even increase by a mere 10 %, the deal quickly turns negative.

Thus, properly estimating the resale of a property before striking it down at auction is imperative in determining the profitability (or lack of) of a foreclosure deal.

So there you have it. Although great bargains can be found, there are also great risks connected with purchasing foreclosures at public auction. So if you want to not worry about of the fore mentioned, Nick & Cindy Davis can assist you in finding your new home here in the Tampa Bay and Surrounding Areas. We are always just a click here or call to 813-300-7116 away.

Take a look at a few of the most recent homes that came on the market here in the Tampa Area.

- List View

- Map View

- Grid View

See all Real estate matching your search.

(all data current as of

3/31/2025)

Listing information deemed reliable but not guaranteed. Read full disclaimer.

- List View

- Map View

- Grid View

See all Real estate matching your search.

(all data current as of

3/31/2025)

Listing information deemed reliable but not guaranteed. Read full disclaimer.

- List View

- Map View

- Grid View

See all Real estate matching your search.

(all data current as of

3/31/2025)

Listing information deemed reliable but not guaranteed. Read full disclaimer.

- List View

- Map View

- Grid View

-

-

Lot Size8,712 sqft

-

Home Size2,381 sqft

-

Beds5 Beds

-

Baths3 Baths

-

Year Built2011

-

Days on Market1

-

See all Real estate matching your search.

(all data current as of

3/31/2025)

Listing information deemed reliable but not guaranteed. Read full disclaimer.

- List View

- Map View

- Grid View

-

-

Lot Size10,455 sqft

-

Home Size3,017 sqft

-

Beds5 Beds

-

Baths4 Baths

-

Year Built1990

-

Days on Market1

-

See all Real estate matching your search.

(all data current as of

3/31/2025)

Listing information deemed reliable but not guaranteed. Read full disclaimer.