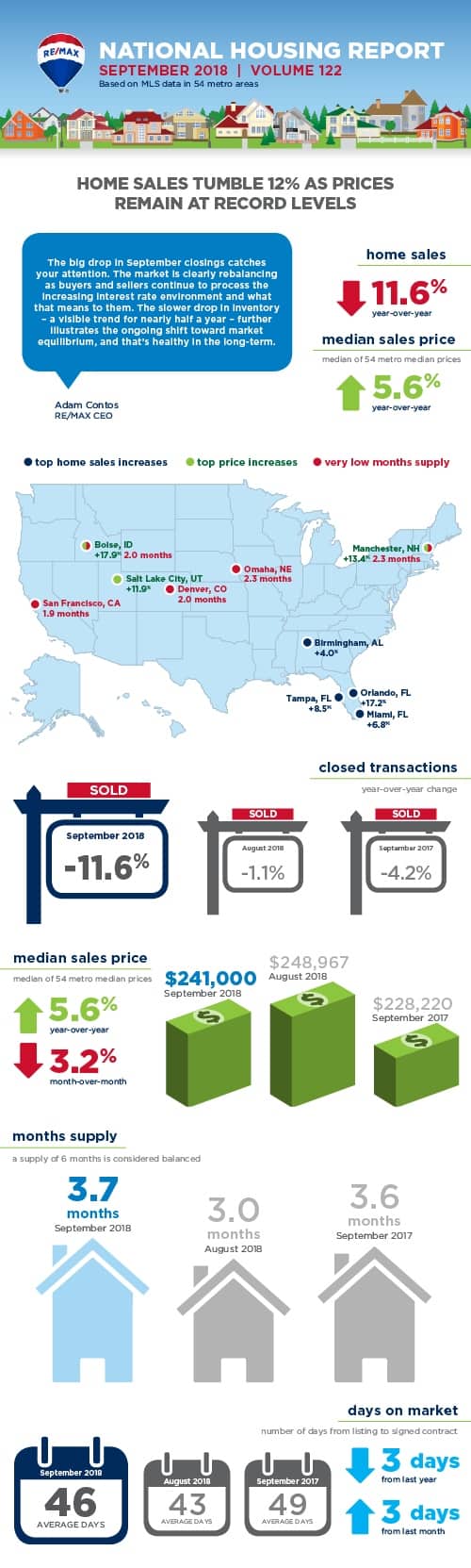

The November 2018 housing report uses the numbers for October 2018. While July home sales decreased slightly, homes sold at a quicker rate than any month in nearly 10 years, in accordance with the August RE/MAX National Housing Report that analyzes housing data in 54* metro areas.

November 2018 RE/MAX National Housing Report

Years of shrinking inventory gave way in November to a second consecutive month of year-over-year boost in the number of homes for sale, in accordance with the RE/MAX National Housing Report. The apparent reason: Home sales declined for the fourth consecutive month in comparison to the same months in 2017. All the same, home prices remained strong.

Throughout the 53 metro areas surveyed, inventory rose 3.0% – the greatest monthly year-over-year gain in the 10-year history of the report, following October’s 1.0% increase that ended a streak of 119 months of year-over-year declines dating back to November 2008. The Months Supply of Inventory rose to 3.9, the highest for any month since 4.2 in December 2016.

November home sales, meanwhile, declined 6.9%, which was the second-largest year-over-year decline of 2018 and the biggest year-over-year sales decline for November in five years. This year only April and July sales exceeded 2017 totals for the corresponding months.

“The road to market normalization can be bumpy,” said RE/MAX CEO Adam Contos. “It’s good to see the small uptick in inventory, and the drop in November sales isn’t too surprising – given the recent trends, the mid-term elections, and the earlier-than-usual Thanksgiving holiday. As we near year-end, three main themes appear clear – buyers are grappling with affordability issues and tight inventory; sellers are unsure how to react to the cooling market; and homes priced properly are still selling rather quickly. All three underscore the fact that the guidance of a professional agent is even more critical in times like these.”

November’s Median Sales Price of $235,000 was 4.0% above November 2017 and was the highest November price in the report’s history. It marked the 32nd consecutive month of yearover-year price increases. Comparing the first 11 months of 2018 to 2017, home prices are up 6.0%.

Despite declining sales, homes sold at record speed for November. Homes spent an average of 51 Days on Market, when compared to the previous November low of 54 days set last year.

Closed Transactions

Of the 53 metro areas surveyed in November 2018, the overall average number of home sales is down 10.1% compared to October 2018, and down 6.9% compared to November 2017. Nine of the 53 metro areas experienced an increase in sales year-over-year, including Burlington, VT, +8.8%, Albuquerque, NM, +6.8%, New Orleans, LA, +5.4% and Tampa, FL, +5.1%.

Median Sales Price – Median of 53 metro median prices

In November 2018, the median of all 53 metro Median Sales Prices was $235,000, equivalent to October 2018, and up 4.0% from November 2017. Only two metro areas saw a year-over-year decrease in Median Sales Price: Honolulu, HI, -3.2%, and Birmingham, AL, -0.7%. Three metro areas increased year-over-year by double-digit percentages: Boise, ID, +18.2%, Las Vegas, NV, +12.2%, and Wichita, KS, +11.4%. Days on Market – Average of 53 metro areas The average Days on Market for homes sold in November 2018 was 51, up three days from the average in October 2018, and down three days from the November 2017 average. The metro areas with the lowest Days on Market were Omaha, NE, at 26; San Francisco, CA, at 31; Boise, ID, and Nashville, TN, both at 33; and at 34, Salt Lake City, UT, Denver, CO, and Las Vegas, NV. The highest Days on Market averages were in Augusta, ME, at 110, Hartford, CT, at 90, and at 78, Chicago, IL, and Miami, FL. Days on Market is the number of days between when a home is first listed in an MLS and a sales contract is signed.

Months Supply of Inventory – Average of 53 metro areas

The number of homes for sale in November 2018 was down 7.1% from October 2018 and up 3.0% from November 2017. Based on the rate of home sales in November, the Months Supply of Inventory increased to 3.9 from 3.5 in October 2018, and increased compared to November 2017 at 3.6. A six-month supply indicates a market balanced equally between buyers and sellers. In November 2018, all of the 53 metro areas surveyed except Miami, FL, at 9.0, and Augusta, ME, at 7.0, reported a months supply at or less than six, which is typically considered a seller’s market. The markets with the lowest Months Supply of Inventory were, at 2.0, San Francisco, CA, Boise, ID, and Denver, CO, with Minneapolis, MN, next at 2.2.

To get a copy of this report:

Nick & Cindy Davis with RE/MAX Premier Group are here to assist you with all your Real Estate Needs. We are always available at 813-300-7116 to answer your questions or you can simply click here and we will be in touch with you shortly.

Ways Our Family Can Help Your Family

All Homes For Sale Around Tampa

- List View

- Map View

- Grid View

-

-

Lot Size12,633 sqft

-

Home Size1,776 sqft

-

Beds3 Beds

-

Baths2 Baths

-

Year Built1975

-

Days on Market1

-

-

-

Lot Size7,841 sqft

-

Home Size1,779 sqft

-

Beds4 Beds

-

Baths2 Baths

-

Year Built1975

-

Days on Market1

-

-

-

Lot Size

-

Home Size1,145 sqft

-

Beds2 Beds

-

Baths2 Baths

-

Year Built1991

-

Days on Market1

-

-

-

Lot Size12,633 sqft

-

Home Size1,736 sqft

-

Beds3 Beds

-

Baths2 Baths

-

Year Built2007

-

Days on Market1

-

-

-

Lot Size5.01 ac

-

Home Size1,235 sqft

-

Beds2 Beds

-

Baths2 Baths

-

Year Built1984

-

Days on Market1

-

-

-

Lot Size1,307 sqft

-

Home Size1,771 sqft

-

Beds3 Beds

-

Baths3 Baths

-

Year Built2016

-

Days on Market1

-

See all All Homes Around Tampa.

(all data current as of

4/1/2025)

Listing information deemed reliable but not guaranteed. Read full disclaimer.