Attempting to price a home accurately, whether you’re getting ready to sell a house or you’re in a position to make an offer on one, is challenging. Regardless of whether you’ve had experience in the real estate market, a homes value may vary substantially from your initial evaluations.

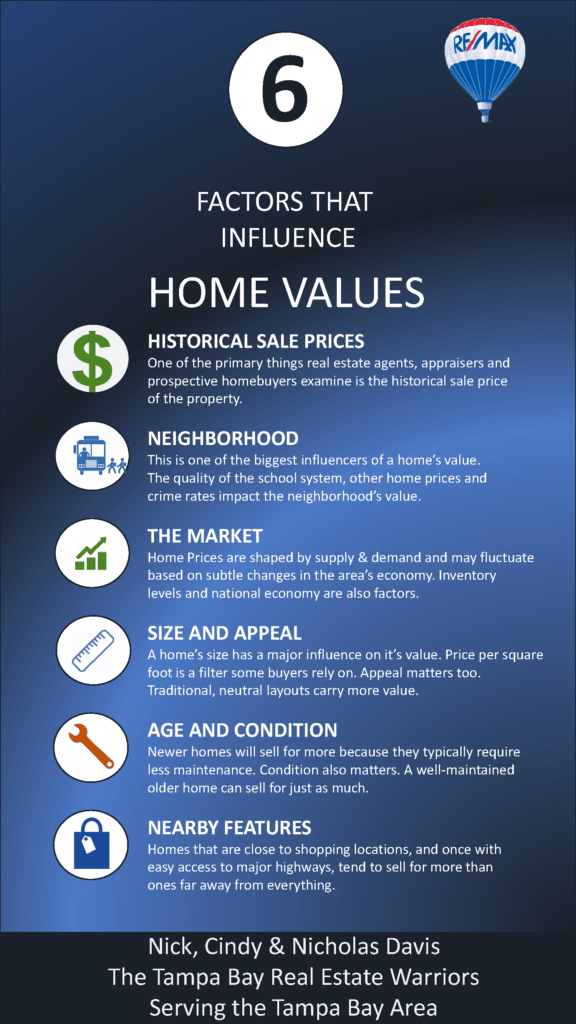

6 variables that have an impact on a home’s value

Effective home valuations help make the home selling process faster and significantly less stressful, and understanding the right value of a home allows you to secure a better deal for your buying client.

Your approach can be accomplished far easier if you boil down the factors to the critical ones that demonstrate having the most powerful effect on a home’s value.

6 factors that influence a home’s value

These are the key factors you’ll want to consider when valuing a home:

1. Historical sale prices

One of the primary things real estate agents, appraisers and prospective homebuyers examine is the historical sale price of the property. If for example the property has been sold three times over the past three years, for $150,000, $155,000 and $153,000, it appears to be reasonable to start off at a valuation around $150,000, and make adjustments dependent upon any new additions or changes to the property.

Historical prices are also usually determined by the other factors on this list.

2. Neighborhood

The neighborhood is probably the biggest influences of a home’s value, a major contributor to both qualitative and quantifiable aspects of a home’s appeal.

As an example, school system quality and home prices usually are strongly correlated.

Research isn’t clear whether home prices influence school system investment, or even if quality schools influence home prices, but no matter what, school quality significantly affects home values.

Crime rates, similarly, are negatively correlated with home values in the neighborhood.

3. The market

The present state of the housing market will additionally influence a home’s value. Home prices are shaped by supply and demand, as with any other economic asset, and may very well fluctuate subject to subtle adjustments to your area’s economy.

To illustrate, if there’s a lack of available houses and an abundance of people trying to move to your area, home prices will rise. In the event the overall national economy is performing well, home prices will also increase.

4. Size and appeal

A home’s size will have a major impact on its value, with many prospective homebuyers looking specifically at price per square foot to filter out this effect and figure out value.

Bigger houses have a tendency to sell for higher prices,needless to say. You’ll also need to evaluate the appeal of the house; traditional, neutral layouts are likely to carry more value than obscure layouts that appeal to only niche audiences.

The more general the appeal of the home,the more its value will likely be (especially considering resale value).

5. Age and condition

In conjunction with size and appeal, you’ll want to consider the home’s age and condition. Newer homes will sell for higher than older homes because they’ll typically require less maintenance.

However, an older home that’s been well-maintained may sell for as much as a newer home – condition matters.

Conditions like the home’s foundation, structural integrity, electrical work, plumbing and fixtures tend to be worth taking into consideration.

6. Nearby features

Finally, you’ll need to consider where the property is located, compared to other accommodations and benefits.

In particular, homes that happen to be near shopping locations, and ones with easy access to major highways, have a tendency to sell for greater than ones miles away from everything.

The more time you spend going over, valuing and comparing homes within your specific area of expertise, the more effective you’ll get at making accurate projections of a home’s potential selling price.

Often times, it’s worth working with a formal appraiser to give a second opinion, or reinforce your valuation with additional authority. Interested in downloading a copy of this graphic? We have made it simple.

Ready to sell your current home? Need to find a new home here in the Tampa Bay Area? Nick & Cindy Davis with RE/MAX Premier Group are here to assist you. We are always a just a click here away or away or give is a call at 813-300-7116

Find Out Value of Your Home

Start Your Personal Search

See All Homes For Sale Around Tampa Florida

- List View

- Map View

- Grid View

-

-

Lot Size5,228 sqft

-

Home Size864 sqft

-

Beds2 Beds

-

Baths2 Baths

-

Year Built1966

-

Days on Market1

-

-

-

Lot Size13,940 sqft

-

Home Size1,442 sqft

-

Beds2 Beds

-

Baths2 Baths

-

Year Built1980

-

Days on Market1

-

-

-

Lot Size26,136 sqft

-

Home Size770 sqft

-

Beds1 Bed

-

Baths1 Bath

-

Year Built1980

-

Days on Market1

-

-

-

Lot Size2.41 ac

-

Home Size768 sqft

-

Beds1 Bed

-

Baths1 Bath

-

Year Built1979

-

Days on Market1

-

-

-

Lot Size7,841 sqft

-

Home Size1,296 sqft

-

Beds3 Beds

-

Baths2 Baths

-

Year Built2001

-

Days on Market1

-

-

-

Lot Size6,534 sqft

-

Home Size1,056 sqft

-

Beds3 Beds

-

Baths1 Bath

-

Year Built1965

-

Days on Market1

-

-

-

Lot Size12,197 sqft

-

Home Size1,264 sqft

-

Beds2 Beds

-

Baths2 Baths

-

Year Built1979

-

Days on Market1

-

-

-

Lot Size11,762 sqft

-

Home Size1,168 sqft

-

Beds2 Beds

-

Baths2 Baths

-

Year Built1983

-

Days on Market1

-

-

-

Lot Size2,178 sqft

-

Home Size1,961 sqft

-

Beds3 Beds

-

Baths3 Baths

-

Year Built2018

-

Days on Market1

-

-

-

Lot Size4,792 sqft

-

Home Size1,243 sqft

-

Beds3 Beds

-

Baths2 Baths

-

Year Built1971

-

Days on Market1

-

-

-

Lot Size9,148 sqft

-

Home Size1,695 sqft

-

Beds4 Beds

-

Baths2 Baths

-

Year Built1978

-

Days on Market1

-

-

-

Lot Size

-

Home Size1,780 sqft

-

Beds3 Beds

-

Baths3 Baths

-

Year Built2009

-

Days on Market1

-

-

-

Lot Size9,148 sqft

-

Home Size1,293 sqft

-

Beds3 Beds

-

Baths2 Baths

-

Year Built1959

-

Days on Market1

-

See all All Homes Around Tampa.

(all data current as of

4/1/2025)

Listing information deemed reliable but not guaranteed. Read full disclaimer.